Traditional 401k to roth 401k conversion tax calculator

Youre going to have to pay taxes on that money. Estimated deductible portion of balance.

High Earners To Roth 401 K Or Not Greenleaf Trust

Colorful interactive simply The Best Financial Calculators.

. Roth Retirement Savings Plan Modeler. From Now Until Retirement Age. Income tax bracket accumulation phase 0 to 75 Taxation of contribution options.

Affordable easy payroll integrated. Protect Yourself From Inflation. Traditional 401 K Or Roth 401 K Calculator Calculate your earnings and more A 401 k can be an effective retirement tool.

Estimated non-deductible portion of balance. Your actual qualifying contribution may. This calculator will help you to compare the net effects of keeping your traditional Individual Retirement Account.

Ad Learn the Benefits of Rolling Over Your Old 401k to a Fidelity IRA. Years until you retire. Traditional or Rollover Your 401k Today.

10 Best Companies to Rollover Your 401K into a Gold IRA. With the passage of the American Tax Relief Act any 401 k plan that allows for Roth contributions will now be eligible to convert. Over time that adds up to a lot of tax-advantaged.

The Sooner You Invest the More Opportunity Your Money Has To Grow. A conversion has advantages and disadvantages that should be carefully considered before a decision is made. You will save 14826875 over 20 years.

Roth 401 k Conversion Calculator. By using the backdoor method you can contribute up to 6000 7000 if youre 50 or older to your Roth IRA each year. If you are in a 28000 tax bracket now your after tax deposit amount would be 300000.

Roth IRA Conversion Calculator to Calculate Retirement Comparisons. Heres how to covert a 401k to a Roth IRA. The amount you will contribute to your retirement account each year.

Ad Learn the Benefits of Rolling Over Your Old 401k to a Fidelity IRA. Use the tool to compare estimated taxes when you do. If you have a 500000 portfolio download your free copy of this guide now.

Estimated of forgone investment value. 2022 Roth Conversion Calculator. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity.

1 Traditional 401 k deductible account fully funded contributions to Roth 401 k non. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. The procedure to roll over your retirement savings from one account type to another is straightforward.

Ad This guide may be especially helpful for those with over 500K portfolios. This calculator can help you decide if converting money from a non-Roth IRA s including a traditional rollover SEP or SIMPLE IRA to a Roth IRA makes sense. This calculator assumes that you make 12 equal contributions throughout the year at the beginning of each month.

This convert IRA to Roth calculator estimates the change in total net worth. This calculator can help you make informed decisions about performing a Roth conversion in 2022. Make a Thoughtful Decision For Your Retirement.

With the passage of the American Tax Relief Act any 401 k plan that allows for Roth contributions will now be eligible to convert existing pre-tax 401 k. Ad Learn More About Our Roth Traditional IRA Accounts Well Help You Roll Over Your 401K. Ad Open an IRA Explore Roth vs.

As of January 2006 there is a new type of 401 k -- the Roth 401 k. Penelope makes it simple. Use this Roth IRA conversion calculator to project the inflation-adjusted value of your Traditional IRA or 401k at retirement versus the inflation-adjusted value of the same funds at retirement.

K Rollover To Roth Ira. The main drawback of converting a traditional 401k into a Roth 401k is the tax bill that comes with making the switch. Ad Attract and keep employees with 401k plans.

Ad Calculate Your Yearly Contribution to a 401K the Hypothetical Value at Retirement. Strong Retirement Benefits Help You Attract Retain Talent. Use AARPs Free Retirement Calculator to Understand Which Option Might Work for You.

Small business 401k plans with big benefits. Traditional vs Roth Calculator Contributions to a Traditional 401 k or individual retirement accounts are made on a pre-tax basis resulting in a lower tax bill and higher take-home pay.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Pennies And The Backdoor Roth Ira The White Coat Investor Investing Personal Finance For Doctors Roth Ira Ira White Coat Investor

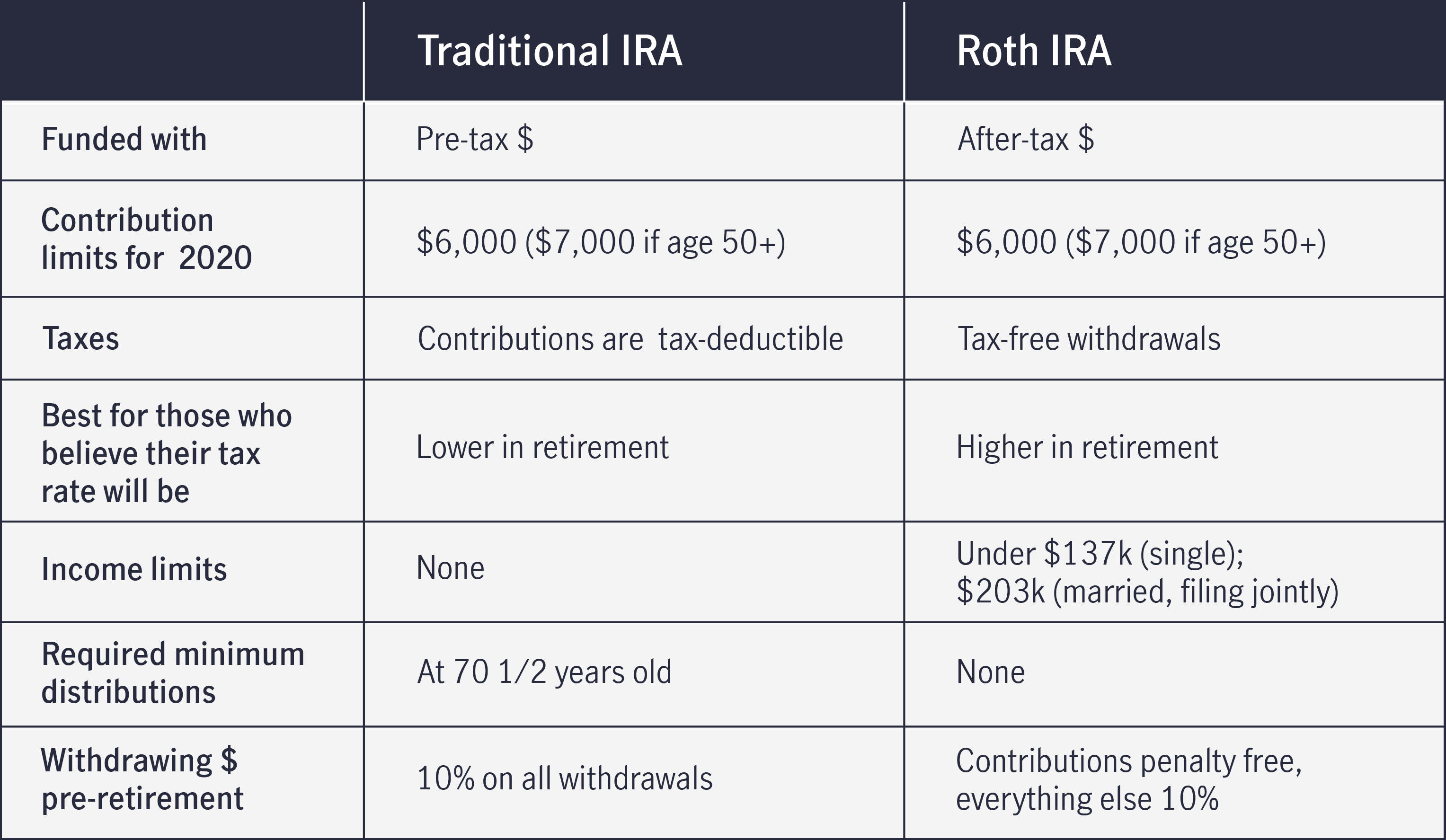

Ira Comparison Roth Vs Traditional Ira Fidelity Roth Vs Traditional Ira Traditional Ira Ira

Roth Conversion Q A Fidelity

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

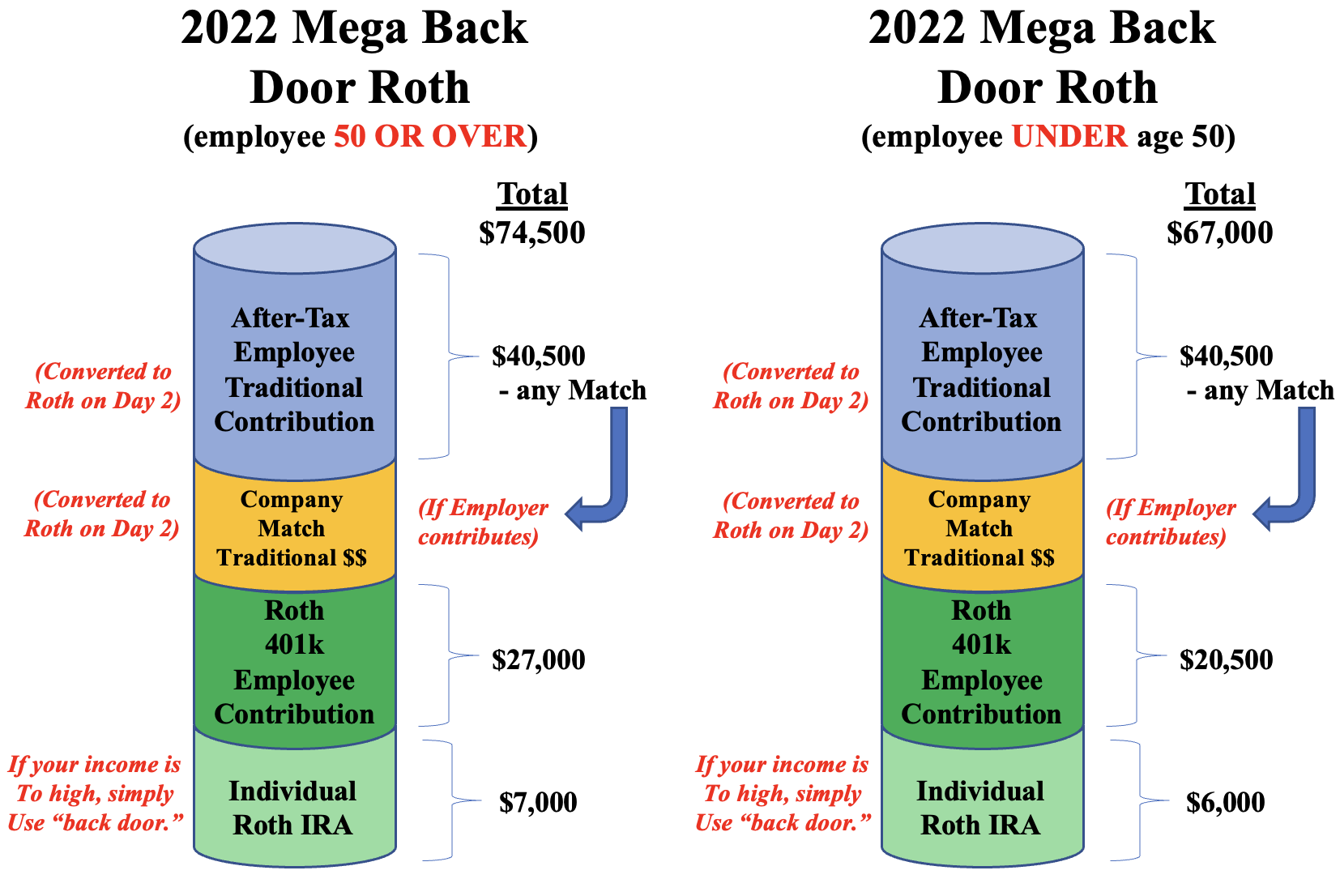

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year

The Ultimate Roth 401 K Guide District Capital Management

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

A Betr Calculation For The Roth Conversion Equation Vanguard

Roth 401k Roth Vs Traditional 401k Fidelity

Comparing Traditional Iras Vs Roth Iras John Hancock

Traditional Vs Roth Ira Calculator

Traditional Vs Roth Ira Calculator

The Magic Of The Mega Backdoor Roth Mark J Kohler

What Are Roth Ira Accounts Nerdwallet Roth Ira Individual Retirement Account Ira Investment

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal